The simple answer to the question "Do i need to fill in an ato tax return is almost always yes. Every working age Australian resident has to fill in a tax return at the end of each year. This does not necessarily mean you will have to pay any tax as like many countries you have a tax free allowance which is about $18000 but that does depend on a lot of things.

...but there are always exceptions to the rule. For example we arrived in May and the tax year in Australia ends on the last day of June. We had not earned any money directly in Oz, or claimed any benefits. Although we had income from rental back in the UK which you have to declare with Australia this was very low as it was only for 2 months and way below the taxation threshold.

I wasn't sure though so went to see an accountant with H&R Block. Emailed him my full circumstances and then went in for a quick 10 min chat. He told me i would not need to fill in a tax return for the previous year but would need to get a mygov account and register with the ATO to tell them that I am not required to fill a tax return in.

The ato also pointed me in the direction of an online tool that allows you to fill in your circumstances and it will tell you if you need to fill in a tax return.

Also below steps for more information and how to get to, and use the ato website and the tax return tool.

Use and Find info on ato website

Visit the ato website https://www.ato.gov.au and enter the page identification code QC 32119

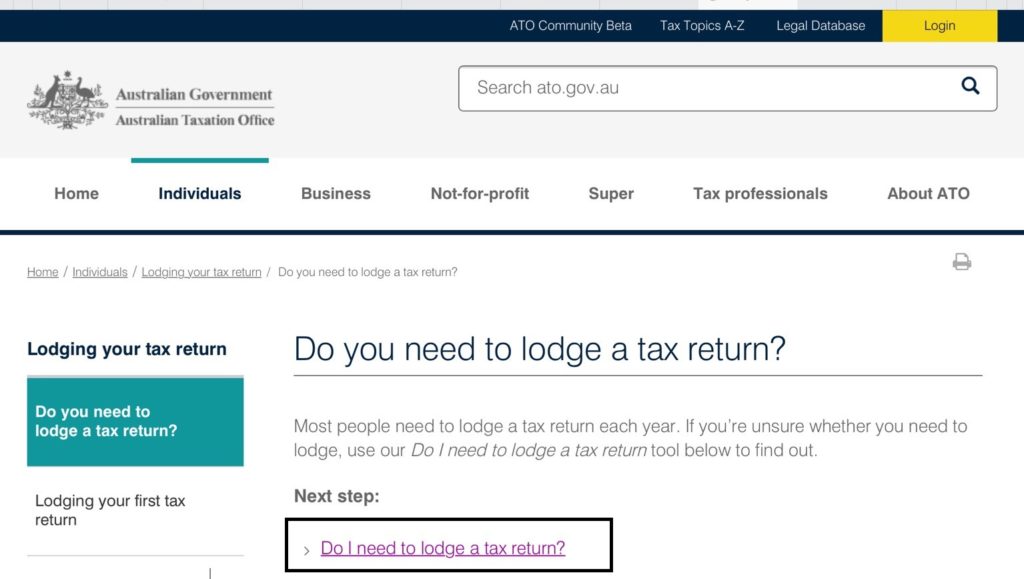

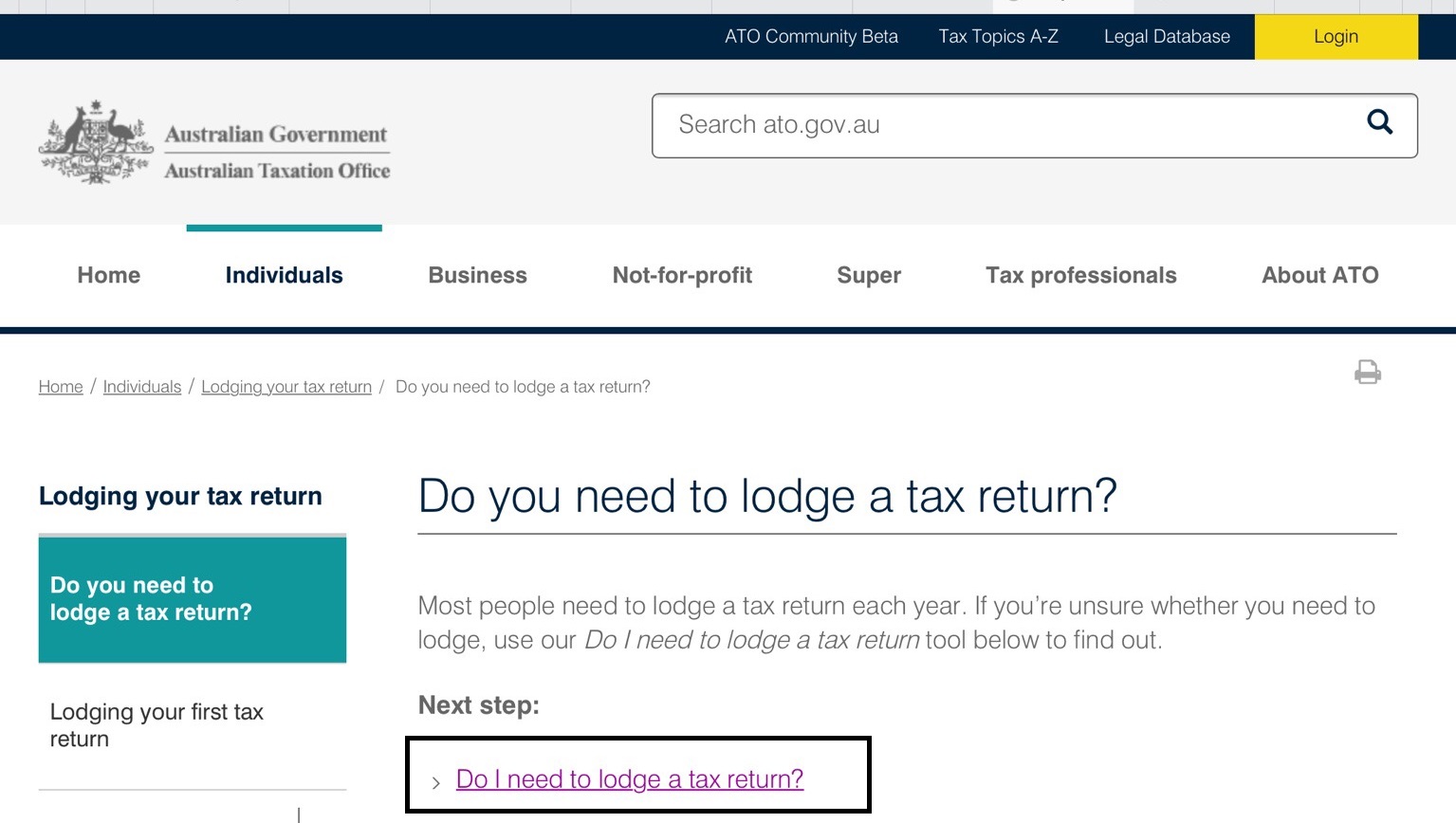

More info regarding whether you need to lodge an ato tax return

Once you have read the info click the "Do I need to lodge a tax return" link

Then click the similar link on the next page, also includes links to previous years

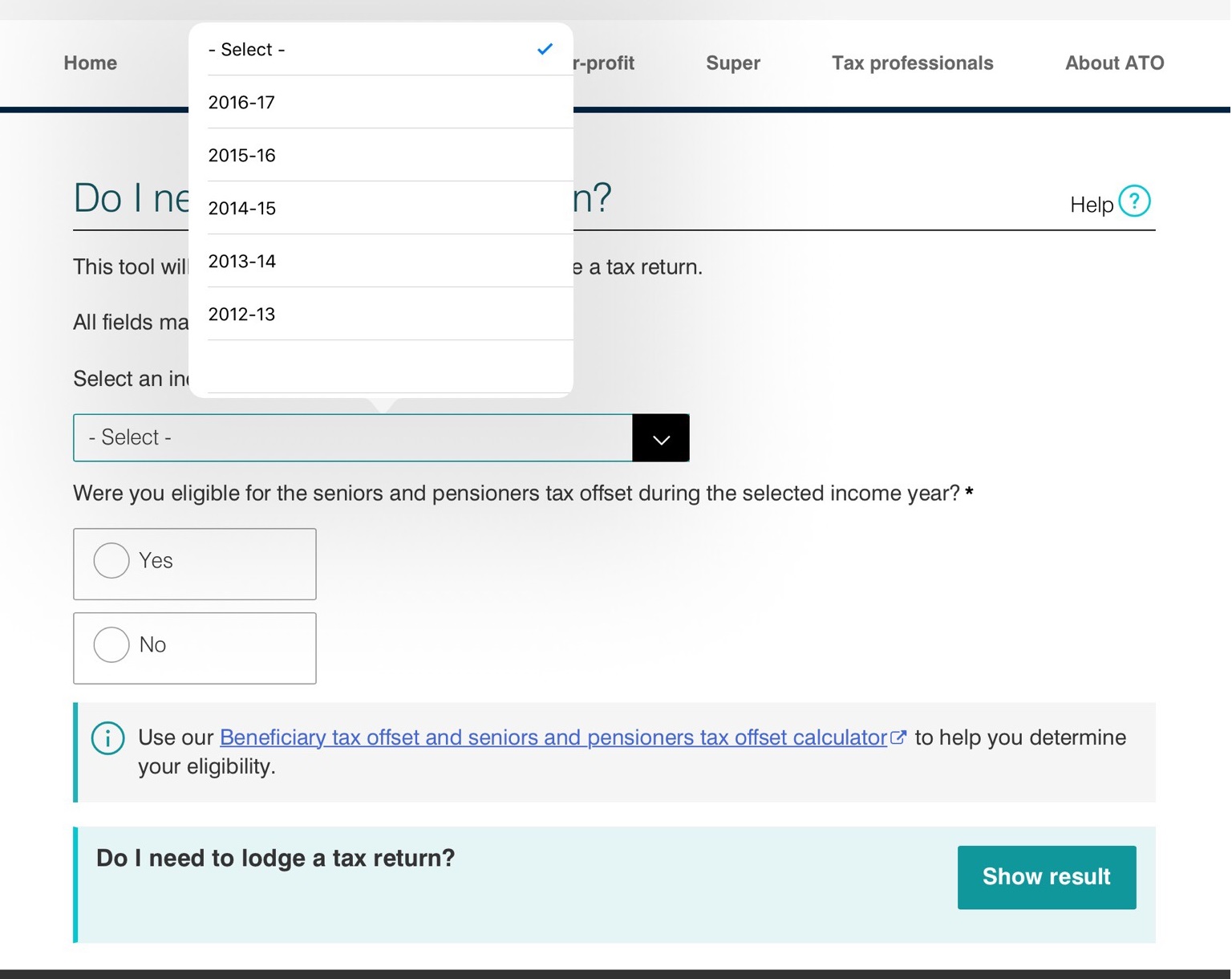

Using "Do I need to lodge a tax return" ato tool

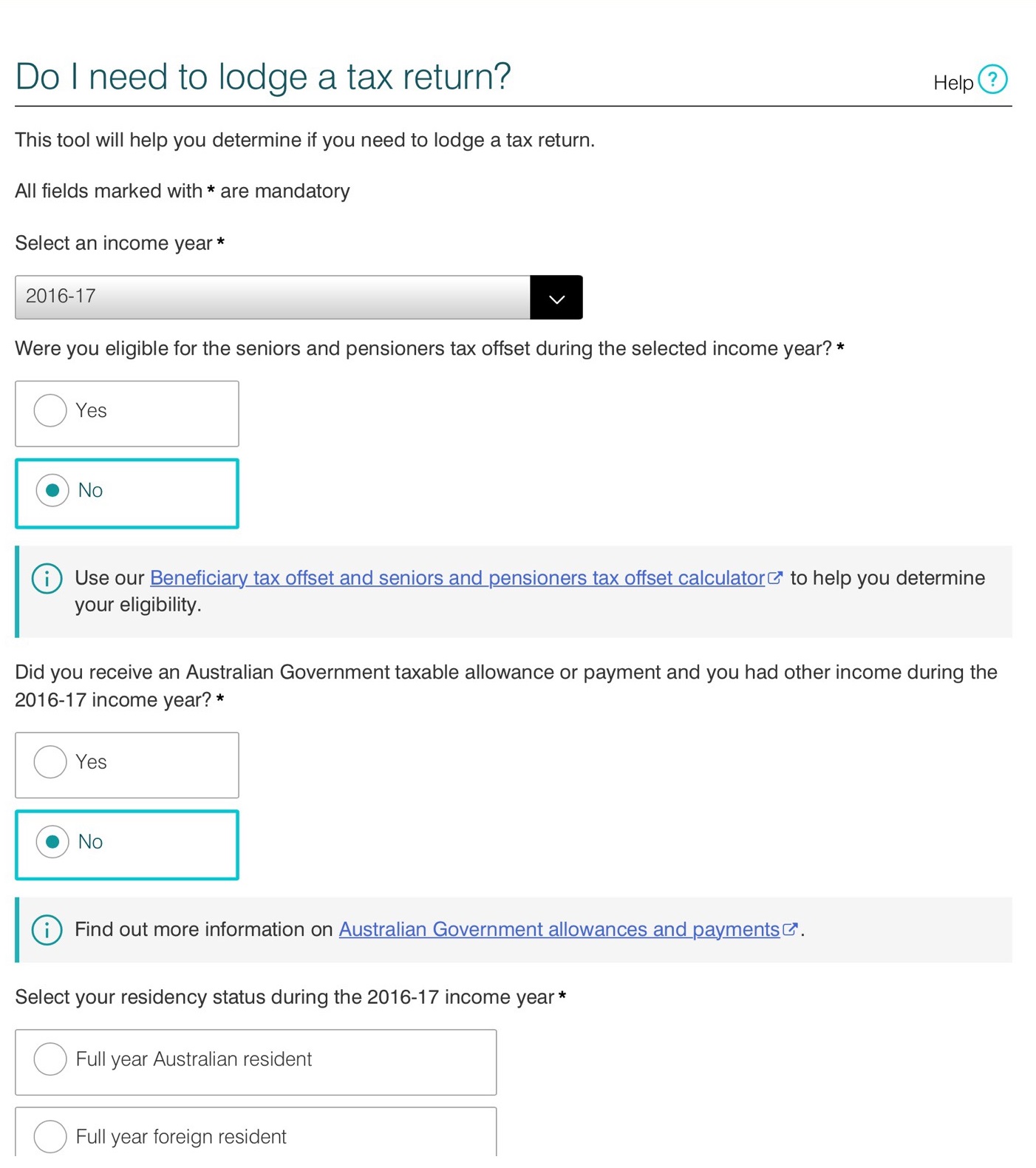

Now it's just a case of entering your details by first selecting the year you want to check

As you answer question more will appear, simply answer them all, such as if you were here for the full year or just part of the year. You also get the opportunity to enter how many months you have been a resident for that tax year.

Once you have answered all the question hit the show result button

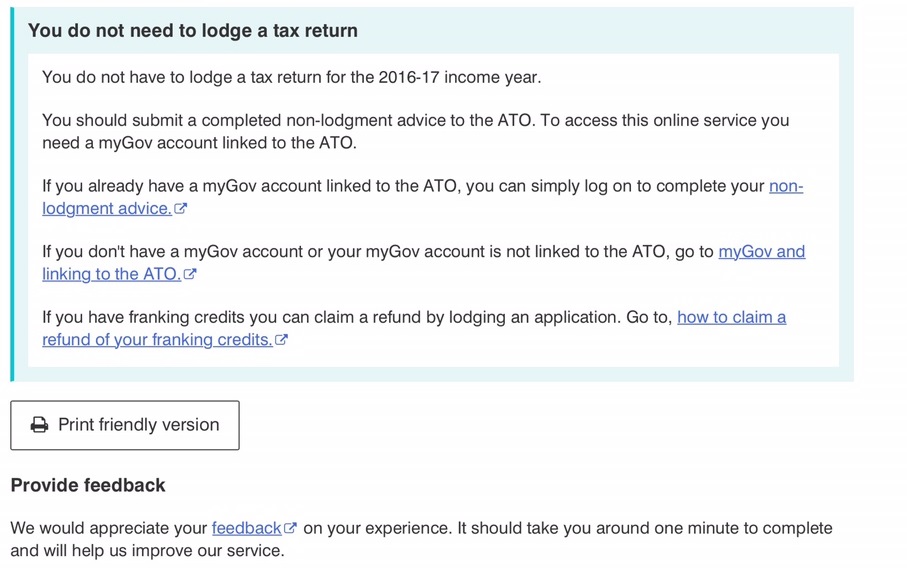

Your result will then be displayed